Whether we look at the market of web-based businesses and online retailers, or the expanding online presence of firms effectively straddling both the tangible and digital worlds, we’ll all notice the same thing: the whole scene is growing like crazy. It’s growing big and it’s growing fast. Perhaps it is that very velocity that has opened up a frustrating gap between the viability and ambitions of digital businesses and the availability of working capital from classic financial institutions.

While we’re flush with tools, frameworks and experts to bridge cash gaps for things like real-estate development projects, there is a lack of similar comfort and competence in growth support for eBay sellers, Amazon sellers, eCommerce sites and companies whose core value is earned through digital channels and online assets. Old-school lenders are struggling to grasp the nuances of the space and when it comes to just needing an injection of cash for three to six months, the last thing small business owners want to worry about is a rigorous pitch cycle that ends up costing them equity.

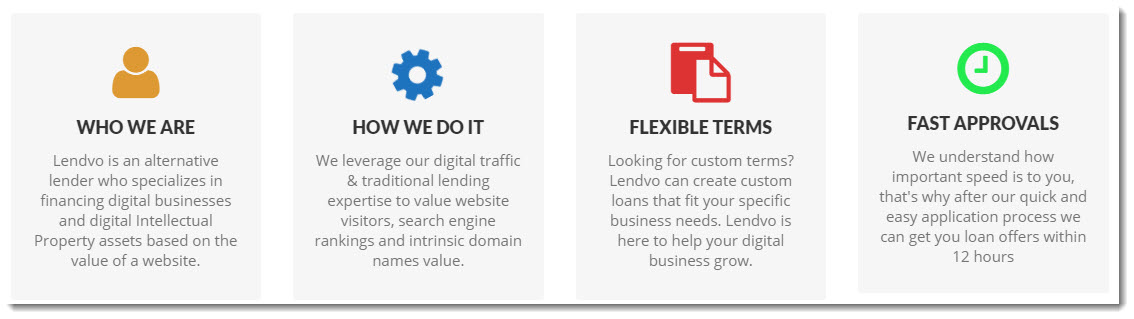

That’s where specialized lenders like Lendvo come in; they understand the ins and outs of web-based business and between their knowledge, speed and flexibility, should be a first stop for web-focused small business owners seeking working capital for short-term operational stability, ramp-ups, expansions and campaign executions.

And again, a key thing to remember is that with a working capital loan from Lendvo, there is no impact to the existing shareholder agreement; they’re not looking to own anything, but simply provide a financial nudge in the right direction.

Perhaps you’re about to go through a slow season, or you need to stock up on inventory, or you need to run a number of marketing campaigns that will result in revenue growth several months down the line; you need somewhere between $5K and $100Kin cash right away, and you project that revenues will allow you to pay off the loan inside of two years. Applying for a Lendvo Working Capital loan is not only easy and flexible, but it’s fast.

While the experts at Lendvo will certainly perform their due diligence – checking credit history, inventory value, company performance and other critical variables – for loans under $100,000 they’ll often be able to provide a response within 24 hours of application receipt. Once you’re an existing client, topping up or increasing an existing loan can be turned around within just a few hours.

In terms of loan size, the company has what they call a “soft cap” of $100K, but are willing to consider larger amounts – the evaluation process and final approval or rejection will just take longer than the usual one or two days.

Because they understand the nature of small digital business, Lendvo working capital loans don’t have much “fixed” about them in the sense that each borrower will ultimately have an agreement that makes sense for their company and their particular initiatives.

That could mean an extremely short loan term or a modest sum, or it could mean more generous interest rates. As a ballpark, borrowers can expect to be paying interest rates comparable to medium-to-high rate credit cards, but again, through thorough analysis, industry knowledge and powerful supporting technology, Lendvo will provide packages to make sure they give each business the best odds at achieving their specific goals.

With working capital from Lendvo, you also don’t have to worry about anyone telling you how to spend your money; borrowers are afforded the discretionary freedom to spend the funds on the priorities they have determined themselves, be it anything from payroll to office supplies.

If you’re a small business focused on online growth and you’re looking for short-term working capital to drive some momentum, you may want to steer clear of the classic clunky, all-too-distracted financial institutions. They’re often chained to antiquated markets and tools, and often can’t stomach these kinds of loans because they can’t properly contextualize the value of online enterprises.

Consider contacting Lendvo and applying for a working capital loan. You can give them a ring at 571.388.2870, email them at [email protected] or visit their website and start filling in an application. In a matter of only 24 hours, you and your business could be in a very different place.